Financial companies and non-financial companies structure reporting differently, which is why we offer two different standardized templates.

We offer both standardized and as-reported Income Statement, Balance Sheet, and Cash Flow Statement items for non-OTC US headquartered public companies filing 10-K and 10-Qs.

Most companies structure their reporting fairly similarly, allowing us to standardize and present their fundamental data in an easy-to-read manner providing for apples to apples comparisons between companies.

The exception to this is financial companies, who report so differently that it's impossible to compare those companies to all other non-financial ones (such as industrial companies).

For example, there are no current or short term items for financial institutions. Their balance sheets are based on liquidation order as opposed to being broken down into time periods like non-financial institutions, i.e. current referring to being realizable in 1 year into cash or payment in cash.

Therefore, we offer two sets of standardized tags: Financial Company Tags and Industrial (aka non-Financial) Company tags.

Our Two Statement Templates

Intrinio currently offers two standardized statement templates, one for industrial companies and the other for banks. Most companies are standardized into the industrial (indu) template and banks are standardized into the financial template (fin).

Industrial vs. Financial

To better understand the difference between the two statement templates, we'll use examples from Apple's (AAPL) and JPMorgan Chase's (JPM) filings. It's recommended to access the SEC links provided along with the screen shots as you follow along. Both examples are quarterly (10-Q) filings.

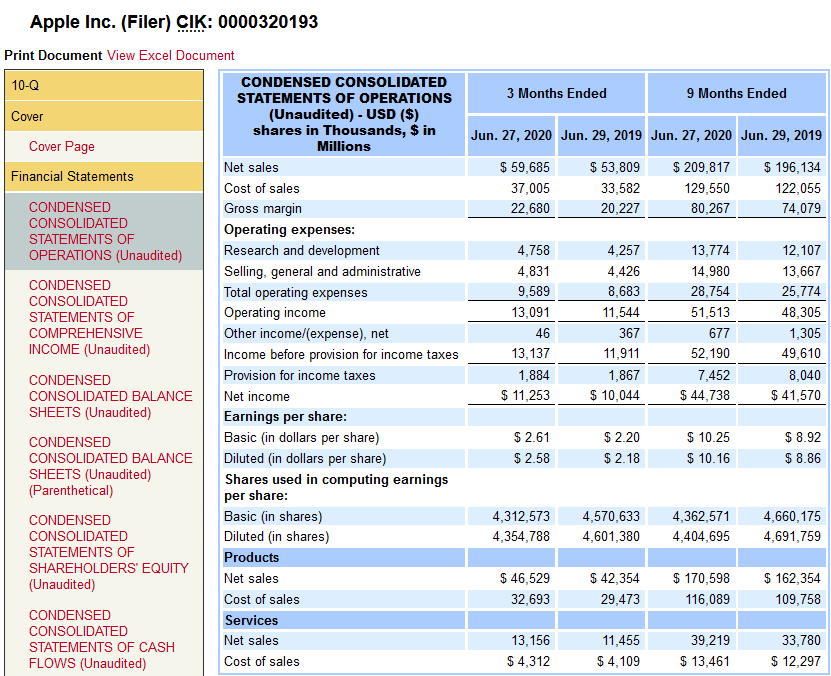

Industrial Income Statement Template Example: Apple (AAPL)

Link to SEC.gov page for Fiscal Period: Q3 2020

Apple's income statement for this period is titled CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited).

Apple is focused on sales, cost of sales, and operating expenses. Essentially, they create products to be sold to consumers. We get a breakdown of the products and services they sell in the dimensions found at the bottom of the statement under Products and Services. iPhones, MacBooks, and Desktops are examples of the products, and services include Apple TV and Apple Music. All of this can be combined into an operations-focused business.

Businesses of this type fit well into the industrial template, which breaks down revenue from sales, the cost of that revenue, and the various expenses which provide us Operating Income (the value that remains once you have added all revenue and subtracted all costs and expenses).

Once the operating income is known, any elements that are not tied to sales (such as Apple's financing business, which will have interest income) is added before the pretax income is determined, which is exactly what it sounds like. This is the total income of all money-generating aspects of their business before they pay taxes. Apple calls their tax bill Provision for income taxes and it is subtracted from Pretax Income to give Net Income.

The remainder of the Income Statement is used to describe the earnings per share and the number of shares used to determine that value. This section can differ depending on the company, but both the industrial template and the financial template handle this section the same way.

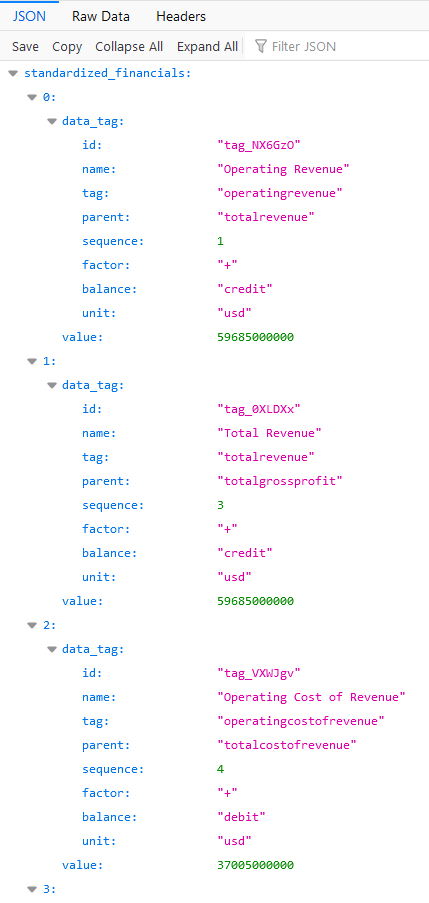

API Results for This Filing

https://api-v2.intrinio.com/fundamentals/AAPL-income_statement-2020-Q3/standardized_financials?api_key=

Note: You can copy and paste the above API call into your browser URL. You will need your API key, which is available on your account page. You can also use this document to test any ticker and period we have available.

If you run the API call, you'll see this is only a small example of the first three tags on the industrial template. Notice how the first tag on the JSON file is operating revenue just as it is on the XBRL filing from the SEC. This will be important when comparing the JPMorgan financial income statement template.

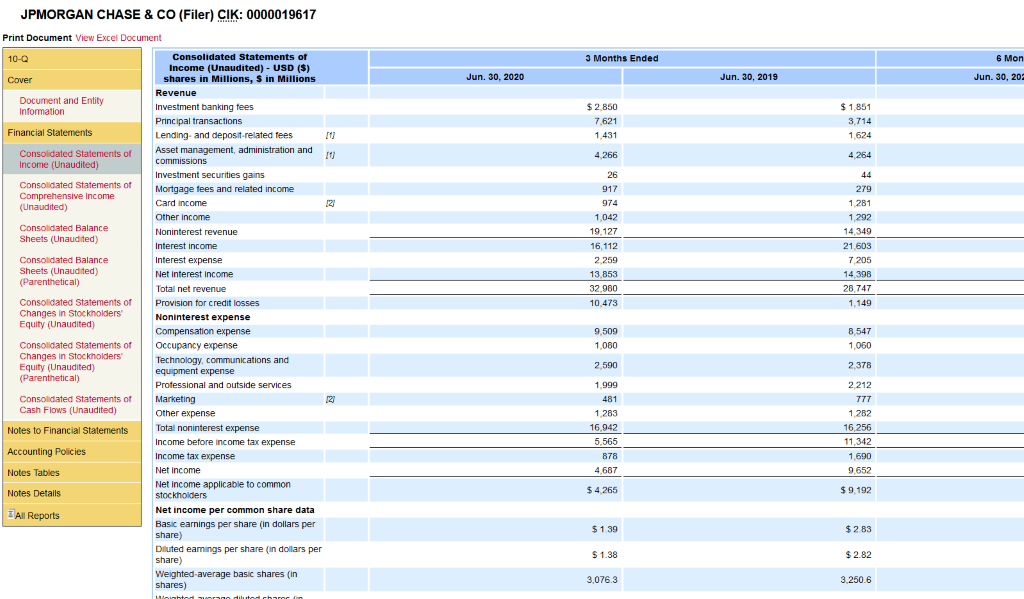

Financial Income Statement Template Example: JPMorgan Chase (JPM)

Link to SEC.gov page for Fiscal Period: Q2 2020

JPMorgan Chase's income statement is titled Consolidated Statements of Income (Unaudited).

JPMorgan Chase is a bank, and they split their revenue and expenses into two sections:

- Non-interest revenue and expenses

- Interest revenue and expenses

Compared to the industrial template, being able to break these into their own sections is valuable to compare banks to banks. For example, if you are performing a comparison of only the interest revenue and expenses, this is easy using the financial template and the tags associated with these concepts. For most companies using the industrial template, this wouldn't make sense to break out as interest revenue and expenses are not broken out into their own sections.

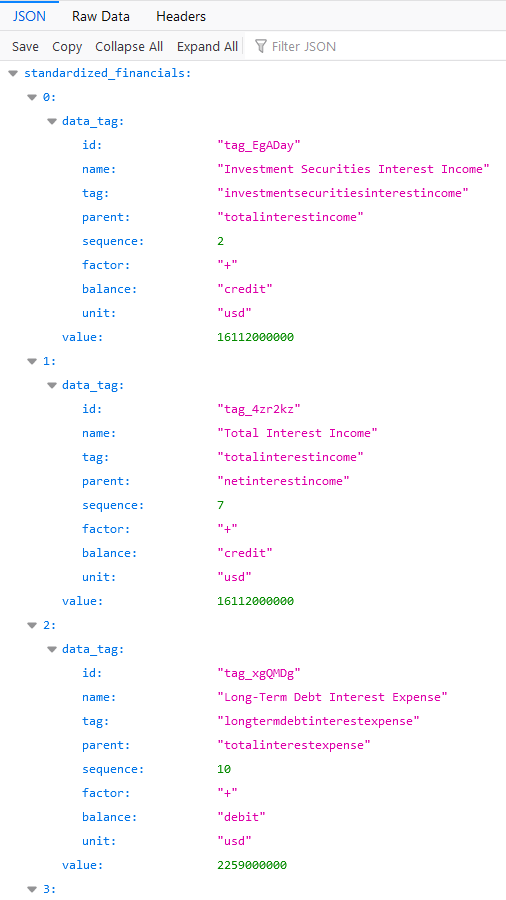

API Results for This Filing

https://api-v2.intrinio.com/fundamentals/JPM-income_statement-2020-Q2/standardized_financials?api_key=

Note: You can copy and paste the above API call into your browser URL. You will need your API key, which is available on your account page. You can also use this document to test any ticker and period we have available.

If you run the API call, you'll see this is only a small example of the first few tags on the financial template. Notice how the first tag on the JSON file is Investment Securities Interest Income which is not the same as operating revenue that we saw with Apple.

Note: Every filing submitted to the SEC is unique and may not have the exact tag that is used on the standardized form.

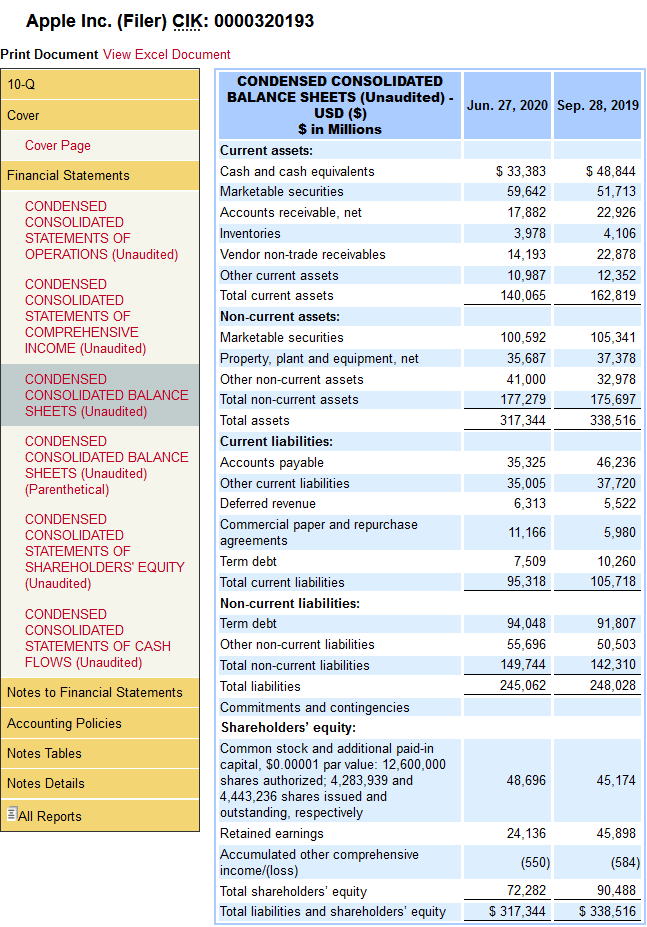

Industrial Balance Sheet Template Example: Apple (AAPL)

Similar to the income statements, there are differences in how the industrial template and the financial template are structured for balance sheets.

Link to SEC.gov page for Fiscal Period: Q3 2020

Apple's balance sheet for this period is titled CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

Balance sheets are typically structured with assets (current/non-current), liabilities (current/non-current) and equity (the difference between the value of total assets and total liabilities). For example, on Apple's balance sheet for this period, they reported total assets of $317,344,000 and total liabilities of $245,062,000 for a total equity of 72,282,000.

Within the total assets you have current assets (assets, like inventory, that is expected to be converted to cash within a year) and non-current assets (assets that are expected to cash after a minimum of 1 year). Liabilities are similar. Current liabilities are due within a year and non-current are due after 1 year. Notice that both current and non-current have similar reported XBRL tags.

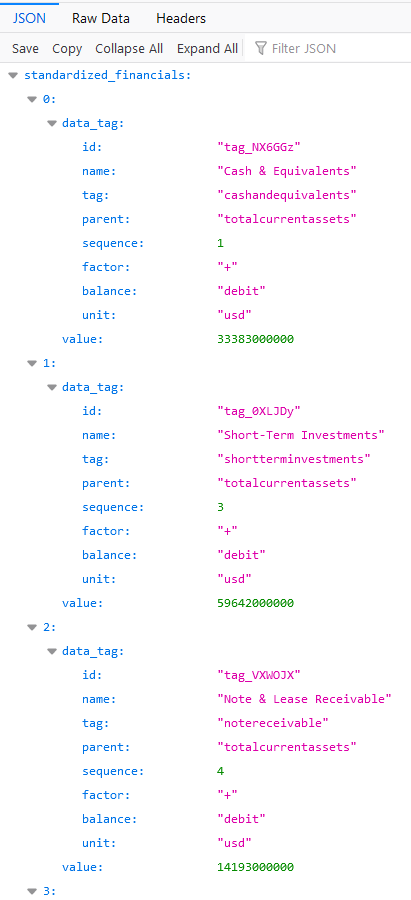

API Results for This Filing

https://api-v2.intrinio.com/fundamentals/AAPL-balance_sheet_statement-2020-Q3/standardized_financials?api_key=

Note: You can copy and paste the above API call into your browser URL. You will need your API key, which is available on your account page. You can also use this document to test any ticker and period we have available.

In this example, both the SEC reported file and the standardized JSON have Cash and Equivalents as the first line item. Other XBRL tags are mapped to standardized tags, like Short-Term Investments which can be an accumulation of reported tags. This is how we can take the vast number of XBRL tags and simplify them into a tag that essentially means the same or is in the same category of assets. This is true of liabilities too.

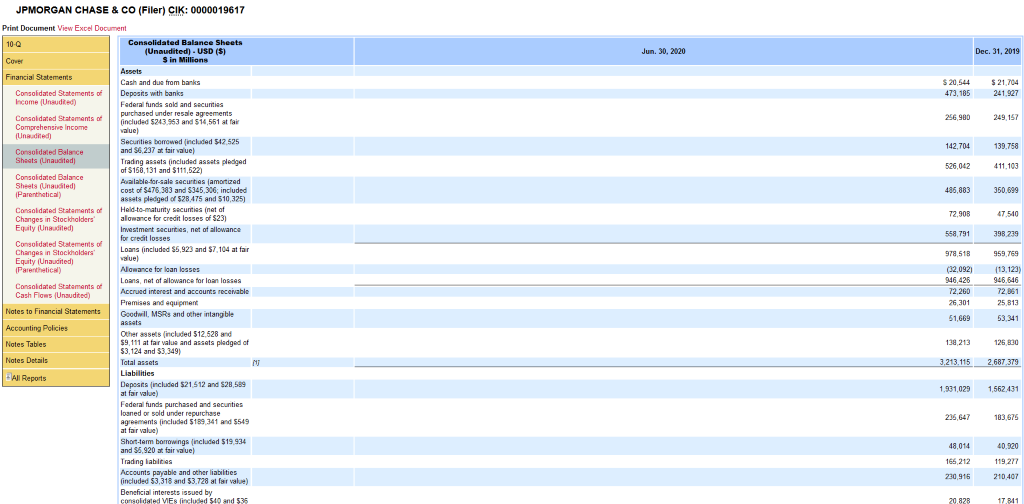

Financial Balance Sheet Template Example: JPMorgan Chase (JPM)

Link to SEC.gov page for Fiscal Period: Q2 2020

JPMorgan Chase's Balance Sheet is titled Consolidated Balance Sheets (Unaudited)

The financial balance sheet template is useful for displaying standardized assets, liabilities, and equity that are unique to banks. For example, the first line item on the JPMorgan Chase balance sheet is Cash and Due from Banks which has a standard tag that better describes where this cash is coming from. It also has common line items tied to financial institutions such as tags related to loans, Federal funds, and interest.

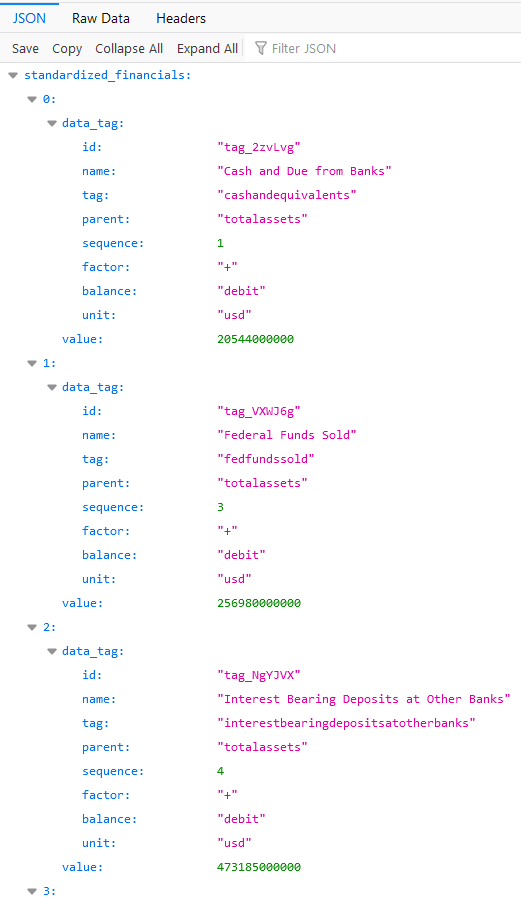

API Results for This Filing

https://api-v2.intrinio.com/fundamentals/JPM-balance_sheet_statement-2020-Q2/standardized_financials?api_key=

Note: You can copy and paste the above API call into your browser URL. You will need your API key, which is available on your account page. You can also use this document to test any ticker and period we have available.

Notice the difference between the JSON results compared to the industrial template used by Apple. The asset tags are tied to banking. It's also interesting to point out that JPMorgan Chase doesn't separate their current and non-current assets/liabilities the same way that Apple does. Every statement is unique to the business that reports them.

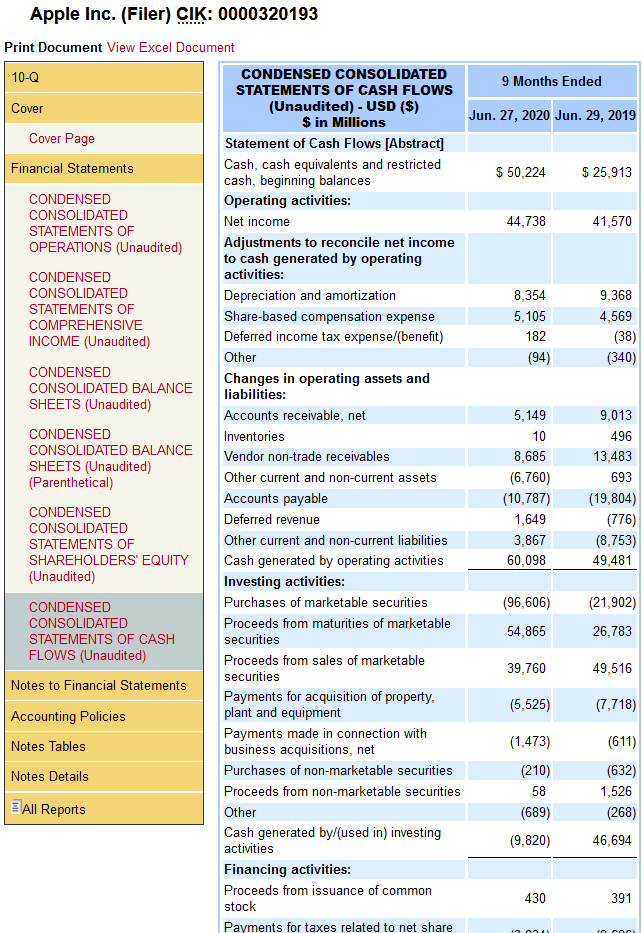

Industrial Statement of Cash Flows Template Example: Apple (AAPL)

Note: Cash Flow Statements are reported as year to date (YTD). The API call examples reflect this to match what is on the reported filing for both templates.

Link to SEC.gov page for Fiscal Period: Q3 2020

Apple's Statement of Cash Flows is titled CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

Cash flow statements are typically broken into operating activities, investing activities, and financing activities and how cash flows within the organization related to these activities, followed by a net change in cash and what cash was used to pay for things like income taxes or interest. In the case of Apple, they begin with their restricted cash and net income before listing their financials for each activity class. The net change in cash is positive when they brought in more cash than they spent, which is determined by the amount of cash used in each of the three activities. Simply sum each total and it should result in the net change in cash.

For example, they reported Cash generated by operating activities of $60,098,000, Cash generated by (used in) investing activities of -$9,820,000, and Cash used in financing activities of -$64,463,000, for a total change in cash of -$15,185,000 for this period.

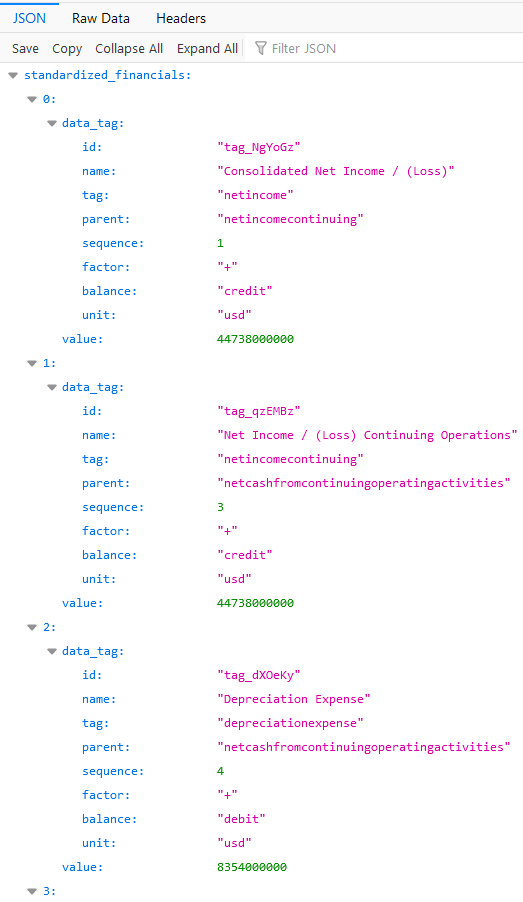

API Results for This Filing

https://api-v2.intrinio.com/fundamentals/AAPL-cash_flow_statement-2020-Q2YTD/standardized_financials?api_key=

Note: You can copy and paste the above API call into your browser URL. You will need your API key, which is available on your account page. You can also use this document to test any ticker and period we have available.

The industrial template begins with Net Income and then lists out the various elements for each type of activity in a standardized way. Just like Apple's reported XBRL statement, Intrinio's industrial template ends with Net Change in Cash and Equivalents, Cash Interest Paid, and Cash Income Taxes Paid.

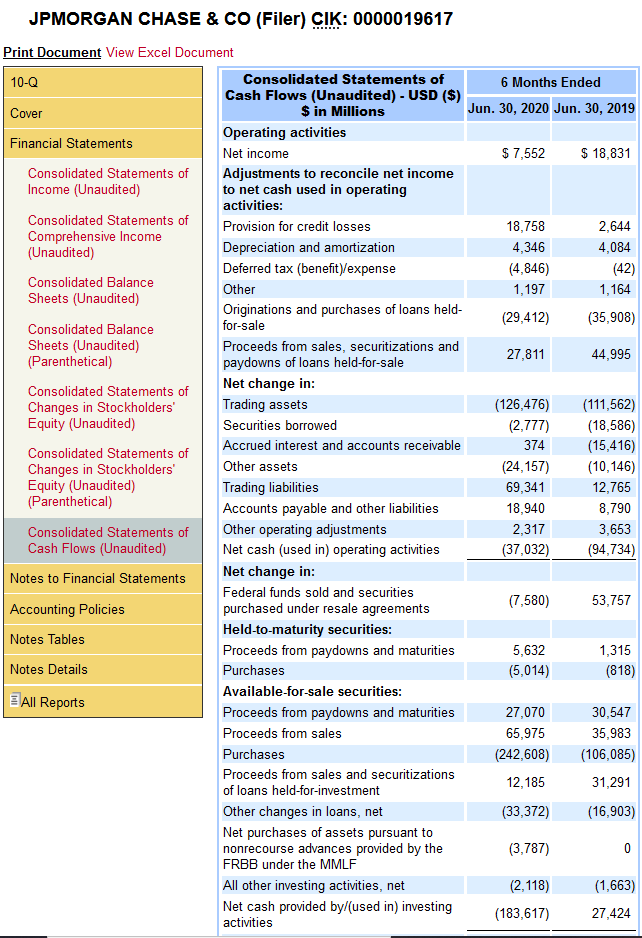

Financial Statement of Cash Flows Template Example: JPMorgan Chase (JPM)

Link to SEC.gov page for Fiscal Period: Q2 2020

JPMorgan Chase's Statement of Cash Flows is titled Consolidated Statements of Cash Flows (Unaudited)

There aren’t many differences between Apple and JPMorgan Chase as it applies to their cash flow statements. They’re broken out the same way, albeit with different tags that are specific to their respective organizations. As a result, the financial template for statements of cash flows is almost the same.

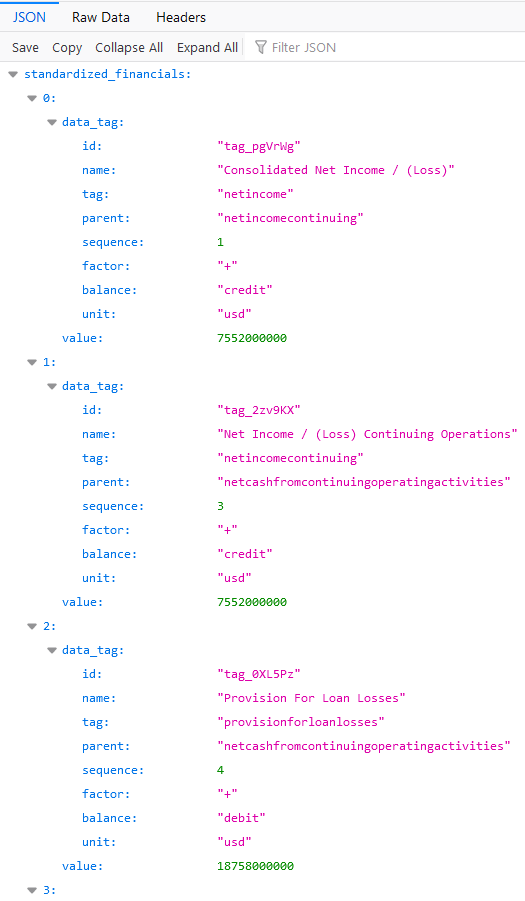

API Results for This Filing

https://api-v2.intrinio.com/fundamentals/JPM-cash_flow_statement-2020-Q2YTD/standardized_financials?api_key=

Note: You can copy and paste the above API call into your browser URL. You will need your API key, which is available on your account page. You can also use this document to test any ticker and period we have available.

Both statements are broken out by the same three activities and the net change in cash works essentially the same. Where the two differ are the line items within the activities. For example, on the financial template there are tags for cash flows due to loans that are not present on the industrial template.

Review

- All companies are required to submit an Income Statement, Balance Sheet, and Statement of Cash flows to the SEC every quarter.

- There are standardized templates for each filing type to facilitate industrial-based companies and banks.

- Statements from Apple and JPMorgan Chase were displayed to show the differences both in what is reported to the SEC and how we standardize the data.